Murray Bridge council rate rise locked in as aged care costs escalate

The cost of running Lerwin Nursing Home and rising wages are two reasons residents will pay more in 2025-26, the Murray Bridge council says.

This story is now free to read. Help Murray Bridge News tell more stories like this by subscribing today.

Murray Bridge ratepayers will face higher property rates bills in 2025-26 to cover a surge in council spending, including at the Lerwin Nursing Home.

Councillors locked in an average rate increase of 4.8 per cent when they finalised the city council’s annual budget at a meeting on June 23.

High wages are one reason council spending will increase by $7.2 million in the next year.

But CEO Heather Barclay suggested the real kicker was the cost of running the Lerwin Nursing Home: $12.1 million per year, more than 50 per cent higher than it was four years ago.

Aged care industry standards had increased, and the council – and ratepayers – were paying for it.

Lerwin will also need upgrades worth $6.8 million over the next seven years, according to a strategic plan for the facility.

“Those costs have continually been absorbed into council’s broader budget,” she said.

“Had council chosen to fully address all of these cost pressures in previous years, significantly higher rates may have been the case.”

If the council only increased property rates in line with inflation, it would return deficits for the next five to six years – a position that would not be tolerated by its lenders at the Local Government Finance Authority, and one which Ms Barclay said would put an unfair debt burden on future generations.

She stopped short of suggesting that the council reconsider its ownership of the nursing home.

None of the councillors made that argument, either.

Lerwin was built using funds donated by the community in the early 1980s, and handed over to the council to be kept in trust.

The council’s last major strategic review of the aged care facility was in 2014, when community members were asked whether it should be kept in public hands or sold to a private operator.

Back then, after an emotional debate, locals made it clear that they wanted the council to maintain its ownership of an important community asset.

Is that still the case?

It is not yet clear whether a review of service levels at Lerwin, ongoing since early 2024, will prompt the council to ask the question again.

Residents’ pleas go unanswered

Meanwhile, the rate rise went ahead despite push-back from a handful of locals during a recent consultation period.

At a meeting in early June, Riverglades resident Jerry Wilson pointed out that the only cuts included in this year’s budget fell under the category which included roads and playground equipment: “the stuff that we, as residents of this town, see”.

Rex Sleeman argued for a better deal for east side residents, especially in light of fast-rising property values in that area.

Another local, Hayley Griffiths, said increasing rates by more than inflation was unfair to low-income households, especially when they were already “exorbitantly high”.

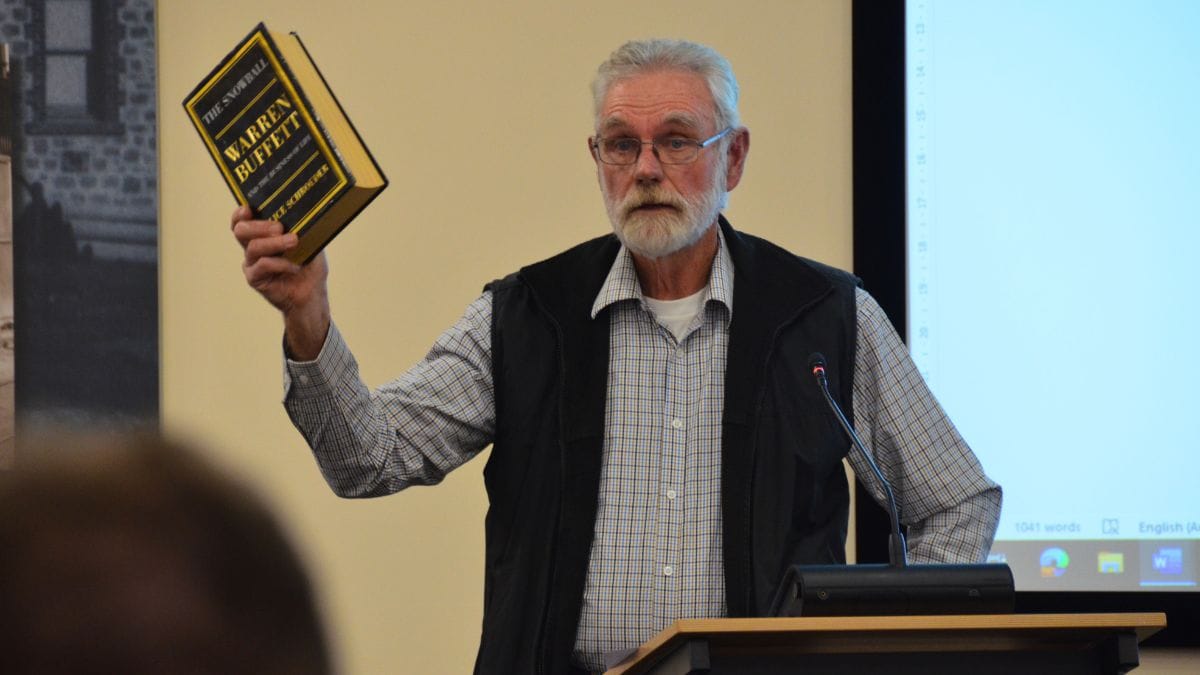

Graham Modra asked councillors whether they had lost sight of their true purpose.

“There’s a million places you could save money,” he said.

“I could walk through anywhere in this building and save 5-10% straight away.”

Only Monarto’s Barry Wilson offered some positive remarks at the meeting, thanking the council for cleaning up piles of waste left along the railway line near his place.

However, council staff advised against making any changes to the budget “as the feedback reflects themes already considered by the council during its development”.

‘Sound financial management’ wins 6-3

A majority of councillors ultimately voted to pass the budget unchanged, but three resisted to the very end: Airlie Keen, Andrew Baltensperger and Clem Schubert.

Cr Keen argued that the rate rise should be no higher than the increase in the Australian Bureau of Statistics’ consumer price index (CPI), a measure of the cost of living.

Cr Andrew Baltensperger went a step further, arguing that people’s property rate bills should be frozen for 12 months.

However, Cr Karen Eckermann suggested the best way to serve ratepayers was with sound fiscal management and good governance.

“We (councillors) are sometimes cast as uncaring villains out to rip people off or put the boot in during a cost-of-living crisis,” she said.

“Nothing could be further from the truth.

“We were elected to make the best decisions on behalf of others.”

Cr Tom Haig agreed, noting that the council’s rate increases had been below the level of inflation for six years.

“It doesn’t take a Rhodes scholar or an accountant to work out that if you’re not increasing the rates every year, by at least CPI, you’re going backwards,” he said.

Cr Fred Toogood described Murray Bridge’s rate rise as “very modest” compared with councils of a similar size.

Racing club’s rate rebate removed

However, councillors did go against a staff recommendation on one matter: a rebate provided to Murray Bridge Racing Club.

Until now, the club has received a discount of 50% on its rates bill every year – almost $64,000 – because it “provides a benefit or service to the local community”.

Cr Tom Haig convinced a majority of councillors that the racing club no longer deserved it.

“Murray Bridge Racing Club provides benefits and services to its members and the racing industry in general, not predominantly to the local community,” he argued.

Cr Keen argued that the club should keep the rebate, because it was a local organisation that supported local jobs, but only two other councillors agreed.

The council will still provide property rate rebates worth around $1.4 million to various other organisations in 2025-26, including Monarto Safari Park, the Murray Bridge hospital, the district’s three private schools, the golf club and the speedway.